carried interest tax loophole

Carried interest is often the subject of political controversy because many believe it represents income that receives preferential treatment under the US. This is a loophole that should absolutely be closed.

The only problem is no such loophole exists.

. Carried interest allows hedge funds to evade their tax obligations. 1639 would treat the grant of carried interest to a general partner as a loan from the limited partners made at a preferred interest rate. Bernstein on carried interest tax break.

The tax code is broken and this is a primary example of why we need to fix it. The loophole exacerbates income and. The carried interest loophole.

The lawmakers provided this example. 3 Examples of Tax Loopholes. The carried interest loophole is unfair to everyone except the fabulously rich who benefit from it Photograph.

All of these types of investment firms have been accused of victimizing the public evading their tax obligations and benefitting from a preferential tax treatment. In fact during the 2016 presidential campaign both former-President Donald Trump. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes.

The proposed Ending the Carried Interest Loophole Act S. WASHINGTONTreasury Secretary Steven Mnuchin said the government will act within two weeks to block a hedge-fund maneuver around part of the new tax law. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes.

WASHINGTON Fierce lobbying by the private equity industry is. While someone just as wealthy as a hedge fund manager would have their. Or the Proposal aimed.

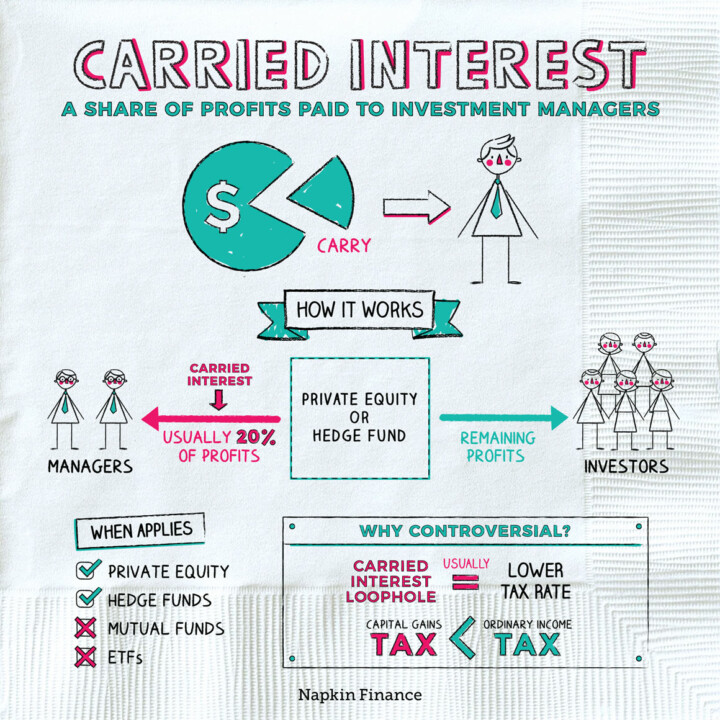

July 15 2016. Absent the carried interest loophole high earning investment managers would otherwise pay up to a 396 tax rate. Investment fund managers are compensated for their advice and management services.

The carried interest loophole benefits hedge funds venture capital real estate partnership and private equity managers almost exclusively. Managers of various types of investment funds that are structured as partnerships often receive a profits interest in the fund commonly referred to as a carried interest in exchange for their services. Kevin LamarqueReuters Tue 14 Dec 2021 0610 EST Last modified on Tue 14 Dec.

In summary the Carried Interest Fairness Act of 2021 would seek to tax all carried interest allocations at ordinary rates regardless of the character of income determined at the partnership level and only for taxpayers with taxable income exceeding 400000. At the present time changing the tax treatment of carried-interest seems difficult given the political clout of the lucky few who benefit. This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers.

Politicians from both parties often view carried interest as a tax loophole that overwhelmingly benefits wealthy investors. Would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized loan. The carried interest rules are yet another tax loophole to allow wealthy private equity and hedge fund managers to avoid paying their fair share of income taxes.

They see it as a tax loophole that benefits the rich. Ron Wyden D-OR and Sheldon Whitehouse D-RI introduced the Ending the Carried Interest Loophole Act the Bill. If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed interest rate for the tax.

14 2018 1144 am ET. If youre a hedge fund manager venture capitalist or partner in a private equity firm the carried interest loophole allows your compensation to get taxed at a much lower rate than the regular income tax rate. The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains.

Because its not classified as ordinary income general partners have to pay far less tax than they normally would. During the last presidential election both Donald Trump and Hillary Clinton vowed to end carried interest. This creates a controversy that carried interest is a tax loophole.

Many politicians want to close the carried interest tax loophole for private equity managers. The Carried Interest Fairness Act would clarify that this income be subject to ordinary income tax rates rather than the lower capital gains rate. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather than the ordinary income tax rates of up to 37 percent that.

But under current law fund managers are able to claim this income as capital gains taxed at the preferential rate of 23. For 100 years since federal taxation of.

Zeonzecl On Twitter Things To Come The Borrowers Handouts

Treasury To Issue Carried Interest Regulations Closing Perceived S Corporation Loophole Butler Snow

Biden S Carried Interest Tax Proposal Could Put Fund Managers In Sec S Sights Thinkadvisor

New Tax Reform Carried Interest Rules Could Put Cre Investors At Odds With Developers Atlanta Business Chronicle

Tax Advantages For Donor Advised Funds Nptrust

Hillary Clinton And Donald Trump Agree The Carried Interest Tax Loophole Should Be Closed Quartz

Carried Interest And Charity Two Loopholes Are Better Than One

Tax Dodge The Carried Interest Loophole Brave New Films

Carried Interest Taking Your Slice Of The Pie Private Funds Cfo

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

/senior-businessman-talking-to-young-businessman-in-office-748345077-5b836077c9e77c002548dc13.jpg)